reverse sales tax calculator nj

See the article. This is the after-tax amount.

Tip Sales Tax Calculator Salecalc Com

Amount without sales tax GST.

. Sales and Gross Receipts Taxes in New Jersey amounts to 163. Average Local State Sales Tax. Current hst gst and pst rates table of 2022.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Reverse Sales Tax Calculator Of New Jersey For 2022. Here is how the total is calculated before sales tax.

Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663. New Jersey has a 6625 statewide sales tax rate. On March 23 2017 the Saskatchewan PST as raised from 5 to 6.

You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. If you want to know how much an item costs without the Sales Tax you might want to. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases.

Enter the total amount that you wish to have calculated in order to determine tax on the sale. For more detail that may include local tax rates or type of purchase you need to consider see. Maximum Local Sales Tax.

In the example above we have explained to you to calculate the Sales Tax amount payable in a. ST is the sales tax This can be useful for making sure you are being charged the correct amount out at stores and for understanding the total percent of the final price that is. Tax rate for all canadian remain the same as in.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. For instance in Palm Springs California the total.

Enter the sales tax percentage. Current HST GST and PST rates table of 2022. Maximum Possible Sales Tax.

New Jersey State Sales Tax. 1 2018 that rate decreased from 6875 to. Reverse Tax Calculator Nj.

Tax rate for all canadian remain the same as in 2017. Enter the final price or amount. This reverse sales tax calculator will calculate your pre-tax price or amount for you.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Sales Tax total value of sale x Sales Tax rate. 1 0075 1075.

Why A Reverse Sales Tax Calculator is Useful. Find your New Jersey combined state. Reverse Sales Tax Formula.

Here is the Sales Tax amount calculation formula. The base state sales tax rate in New Jersey is 6625. A Reverse Sales Tax Calculator is very useful for tax purpose because if you itemize your deductions and claim credit for the overpaid local and out-of-state sales taxes on your.

You will need to input the following. Reverse Sales Tax Calculator Nj.

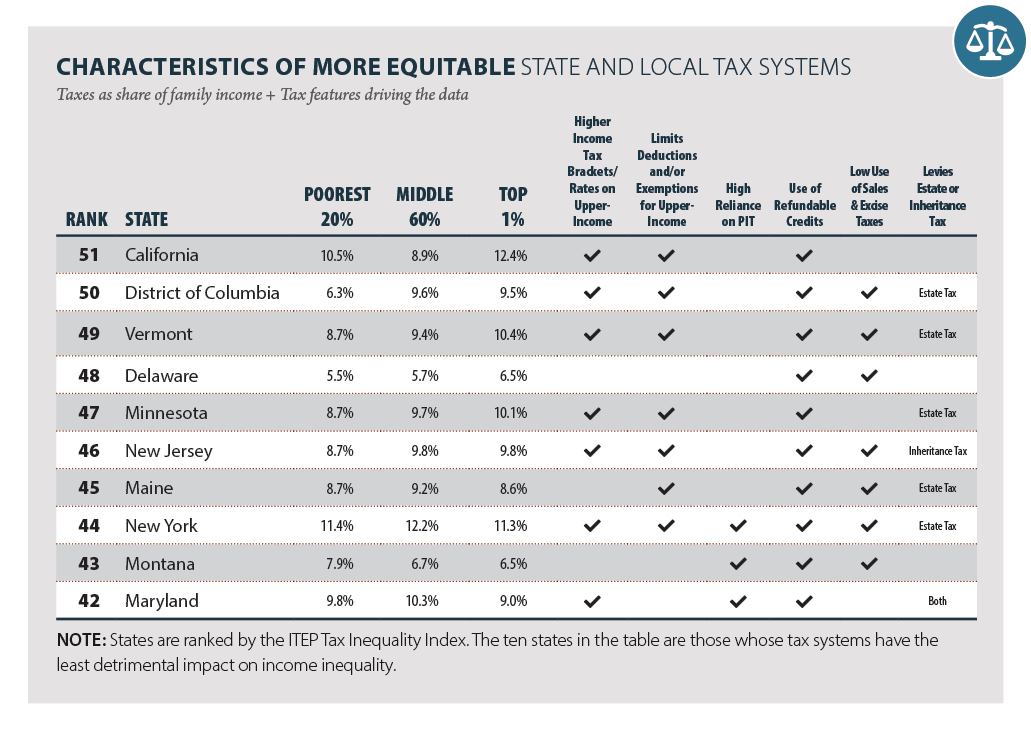

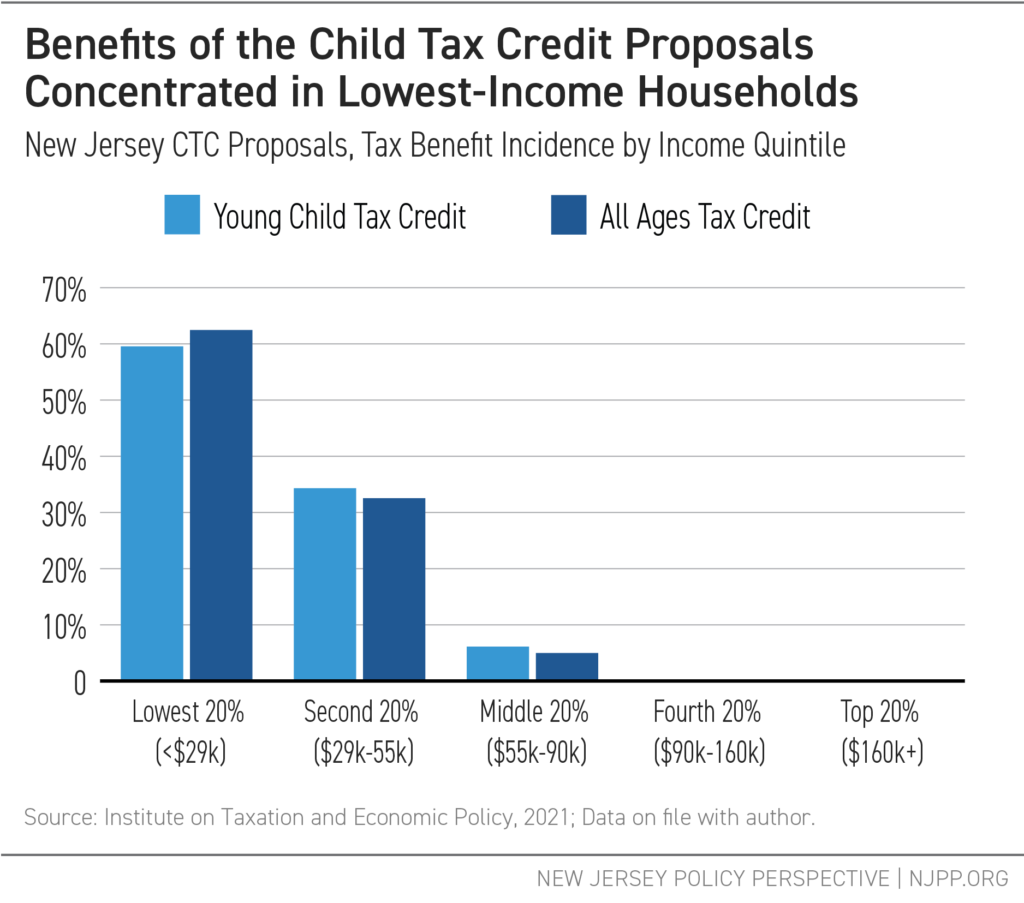

Report Archives New Jersey Policy Perspective

Sales Tax Calculator Check Your State Sales Tax Rate

Sales Tax Recovery Reverse Sales Tax Audit Pmba

Online Sales Tax Compliance Ecommerce Guide For 2022

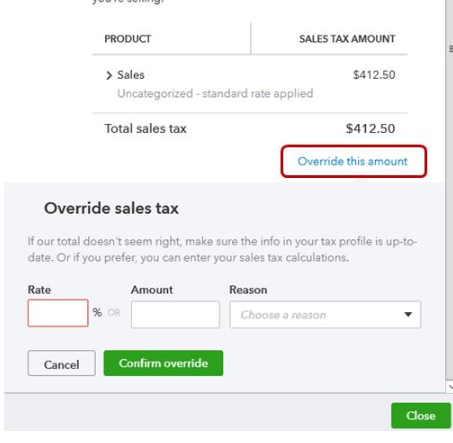

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Kentucky Sales Tax Calculator Reverse Sales Dremployee

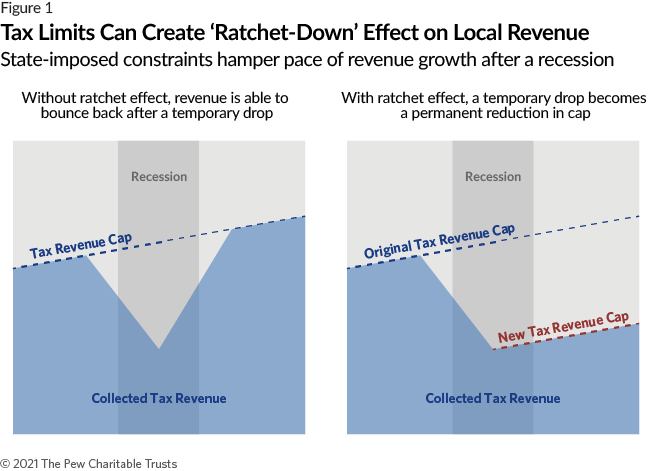

Local Tax Limitations Can Hamper Fiscal Stability Of Cities And Counties The Pew Charitable Trusts

The Impact Of Hybrid Work On Commuters And Nyc Sales Tax Office Of The New York City Comptroller Brad Lander

Best Practices For Sales Tax Display In The Checkout

Extensive Inventory Of New Jaguars For Sale In Marlboro Nj

Corporate Tax In The United States Wikipedia

Sales Tax Calculator Double Entry Bookkeeping

Sales Tax Guide For Online Courses

Reverse Sales Tax Calculator 100 Free Calculators Io

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price